The rise of the MENA fintech hawk – Cyber Tech

I’ve not too long ago had a few attention-grabbing visits to the Center East and Africa, specifically Riyadh and Cairo. Each are eager to focus on progress in fintech, which is attention-grabbing as they’re two cities which have been on my radar however a bit of behind others like Dubai and Lagos. So, I used to be desirous about what would transpire and it didn’t shock that each are growing quick.

Saudi Arabia has been significantly energetic. Since his eminence Salman bin Abdulaziz Al Saud grew to become King in 2015, there was speedy change within the Kingdom. Ladies are allowed to drive, individuals can go to cinemas, and an enormous new metropolis is being constructed on the North coast referred to as Neom. Launched by crown prince Bin Salman in 2017, town goes to be 26,500 sq. kilometres of the neatest technolgoies ever deployed in a brand new construct.

There’s additionally the Line, a two trillion greenback venture to construct a brand new metropolis.

The Line is likely one of the first developments of Neom, and is a linear good metropolis underneath development already within the Tabuk Province. The Line is designed to don’t have any automobiles, streets or carbon emissions.

The Line, deliberate to be 170-kilometre-long (110-mile), is simply one of many 9 introduced areas of Neom and is part of the Saudi Imaginative and prescient 2030 venture, which goals to create 460,000 jobs and add $48 billion to the nation’s GDP.

I used to be conscious of these items, and fascinated to see how fintech has grown up within the nation since I final visited. Again then, fintech wasn’t actually talked about. It was guidelines, laws and the relationsihps between the central banks and business banks. At the moment, it’s all about fintech.

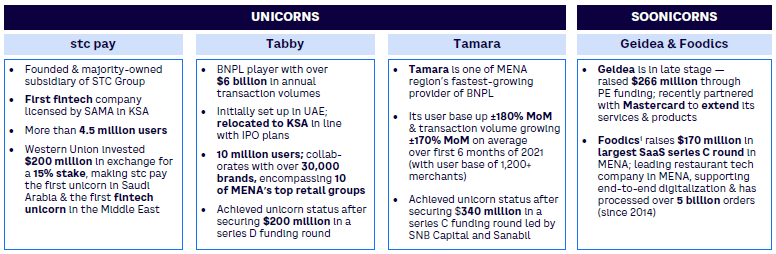

That is recognised in a brand new report printed by Arthur D. Little. The report, titled “Realizing Potential of Fintech in Kingdom of Saudi Arabia”, the consulting agency highlights the speedy development and innovation throughout the sector, spearheaded by initiatives equivalent to Fintech Saudi. Fintech Saudi was launched in April 2018 by the Saudi Central Financial institution, also referred to as SAMA, and the Saudi Capital Markets Authority, and has already seen over $1 billion invested in native fintech corporations.

It is value a learn.

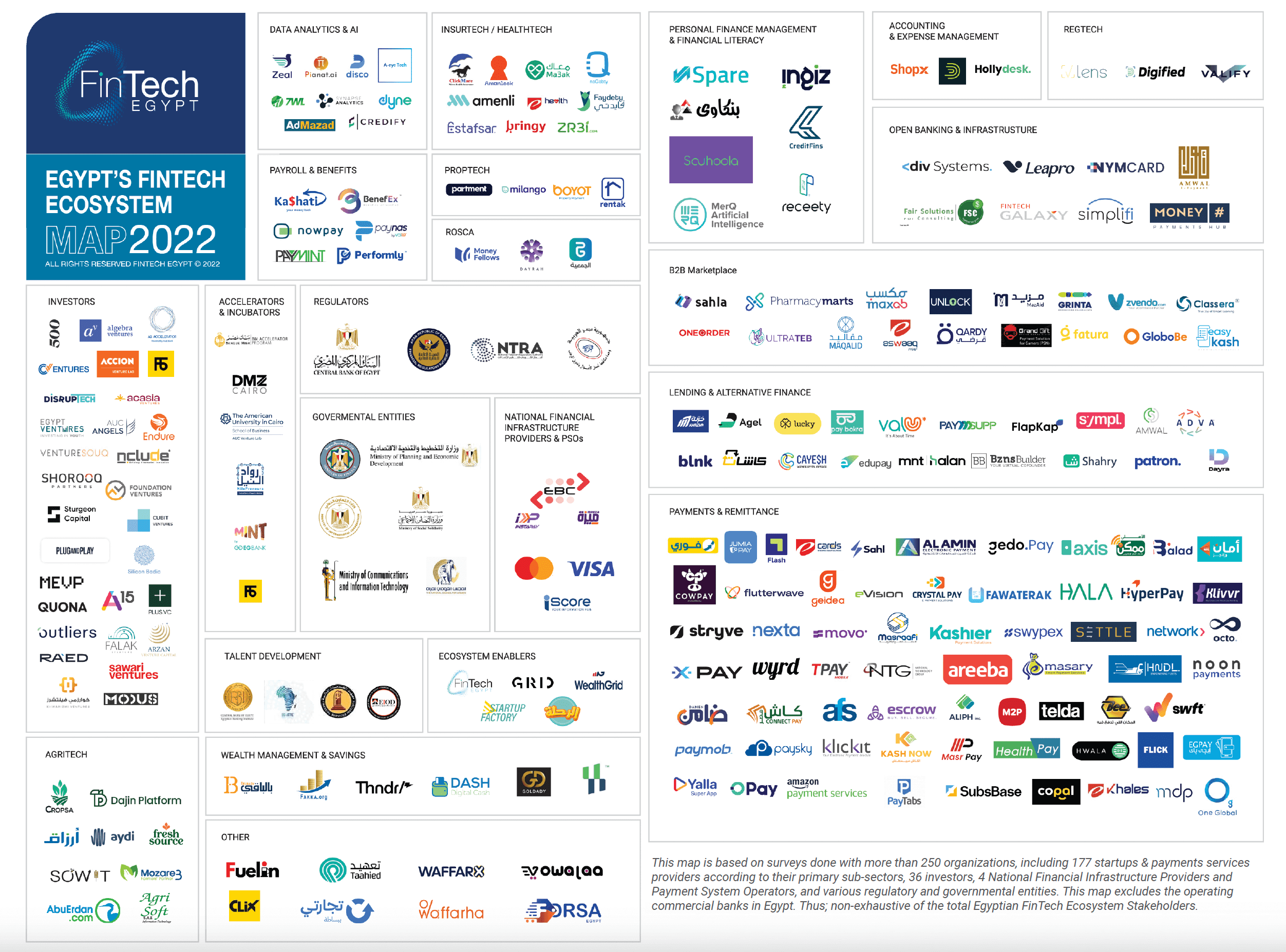

Equally, the Central Financial institution of Egypt has been selling fintech by making a platform: fintech Egypt. Not too long ago additionally they launched a report, analysing the developments within the area, and a key a part of the report jumped out at me.

The report revealed that the Egyptian fintech Investments hit a milestone in 2022, with a complete of $796.5 million invested, the place non-public fairness investments represented $437.7 million, and an additional $358.8 million VC investments. That represents an elevated a number of by 28.7 occasions up to now 3 years.

At the moment, there are 177 fintech and fintech-enabled startups and Cost Service Suppliers (PSPs) providing modern options within the Egyptian market. Out of which, 139 startups present pure FinTech options, whereas 38 present technological options, together with embedded finance.

To place this in perspective, there have been solely two fintech startups in Egypt in 2014, rising to 112 in 2021.

Each Saudi and Egypt are rising quick as fintech centres, as are different international locations. In truth, I can a MENA (Center East and North Africa) burgeoning alliance of fintech centres from Riyadh to Dubai to Cairo to Nairobi to Cape City to Lagos. In different phrases, you might see the day the place these monetary centres work collectively to provide a blanket innovation platform for MENA.

That might be factor.

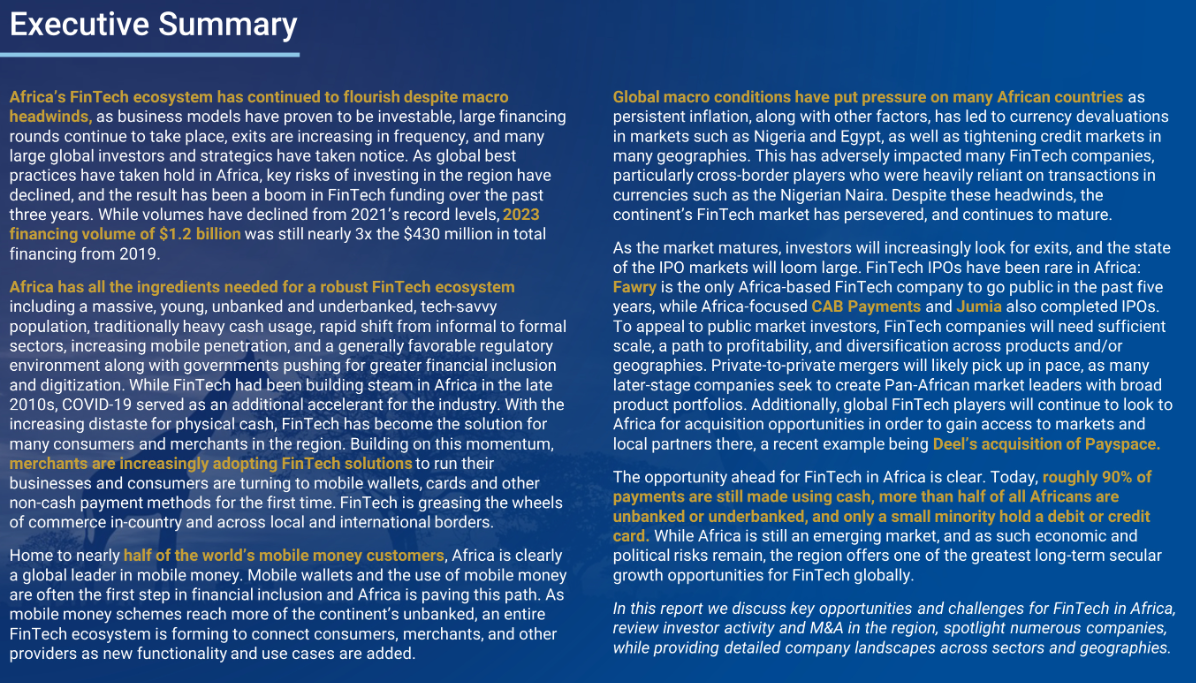

That is one thing explored by FT Companions, a serial investor in start-up fintechs, who simply produced a extremely superb report (218 pages) on the panorama for fintech in Africa total. Their conclusion.

In the meantime, you possibly can obtain all three experiences utilizing the embedded hyperlinks above.