ILS a flexible, adaptable midfield participant providing sturdy, dependable returns: WTW – Cyber Tech

Insurance coverage-linked securities (ILS) comparable to disaster bonds are seen as a flexible and adaptable diversifying technique that may can present traders sturdy, dependable return potential, notably on a risk-adjusted foundation, the Liquid Diversifiers workforce at WTW has stated.

Likening the development of a well-rounded funding portfolio to that of choosing a successful soccer workforce, the WTW consultants clarify that selecting “complementary abilities may help maximize diversification advantages in funding portfolios.”

“Buyers have to assume tougher about their beginning line-up. On one hand, they face extra world market dangers and uncertainties than ever earlier than. On the opposite, diversifiers such because the once-reliable destructive correlation between bonds and equities can now not be taken as a right,” they commented.

Including that, “In our view, liquid diversifiers play a vital position in constructing a portfolio that may assist navigate unsure markets through a wide range of methods with distinctive traits. Buyers require a workforce of those methods, every taking part in their particular person position to create a strong and resilient portfolio.”

When establishing this well-rounded portfolio, sticking with the footballing narrative, the WTW Liquid Diversifiers workforce place insurance-linked securities (ILS) comparable to disaster bonds within the midfield.

Buyers want “an agile midfield that may reply decisively to altering market situations,” however traders and managers additionally require “an skilled workforce supervisor who is ready to direct and rotate tactically so as to get the most effective out of the person parts of the workforce,” WTW believes.

Right here, “An allocation to liquid diversifier methods can obtain success in every of those areas, with the principle goals being to mitigate threat, enhance diversification and, importantly, generate alpha,” they clarify.

The midfield methods, comparable to an allocation to ILS or cat bonds, can add versatility.

“Midfield gamers are versatile and adaptable. They could maintain their floor within the heart of the sector or observe the stream of the sport from finish to finish. You might argue that uncorrelated liquid diversifying methods are the midfield gamers of the alternate options world,” WTW’s consultants state.

Including that, “For instance, insurance-linked securities usually maintain their floor, gathering premia to ship returns whereas the market strikes round them.”

An allocation to ILS, comparable to disaster bonds or reinsurance contracts, permit traders to “profit from regular coupon funds and principal preservation on disaster bonds.”

Additionally noting that, “Return potential from lively allocation additionally tends to be affected by provide and demand dynamics.”

ILS is seen as a method that may ship a “a constant supply of returns over time, regardless of broader market situations,” they clarify.

“Insurance coverage-linked securities (ILS) comparable to disaster bonds are a rising asset class that may present sturdy, dependable return potential, notably on a risk-adjusted foundation, whereas remaining uncorrelated with world equities,” they proceed.

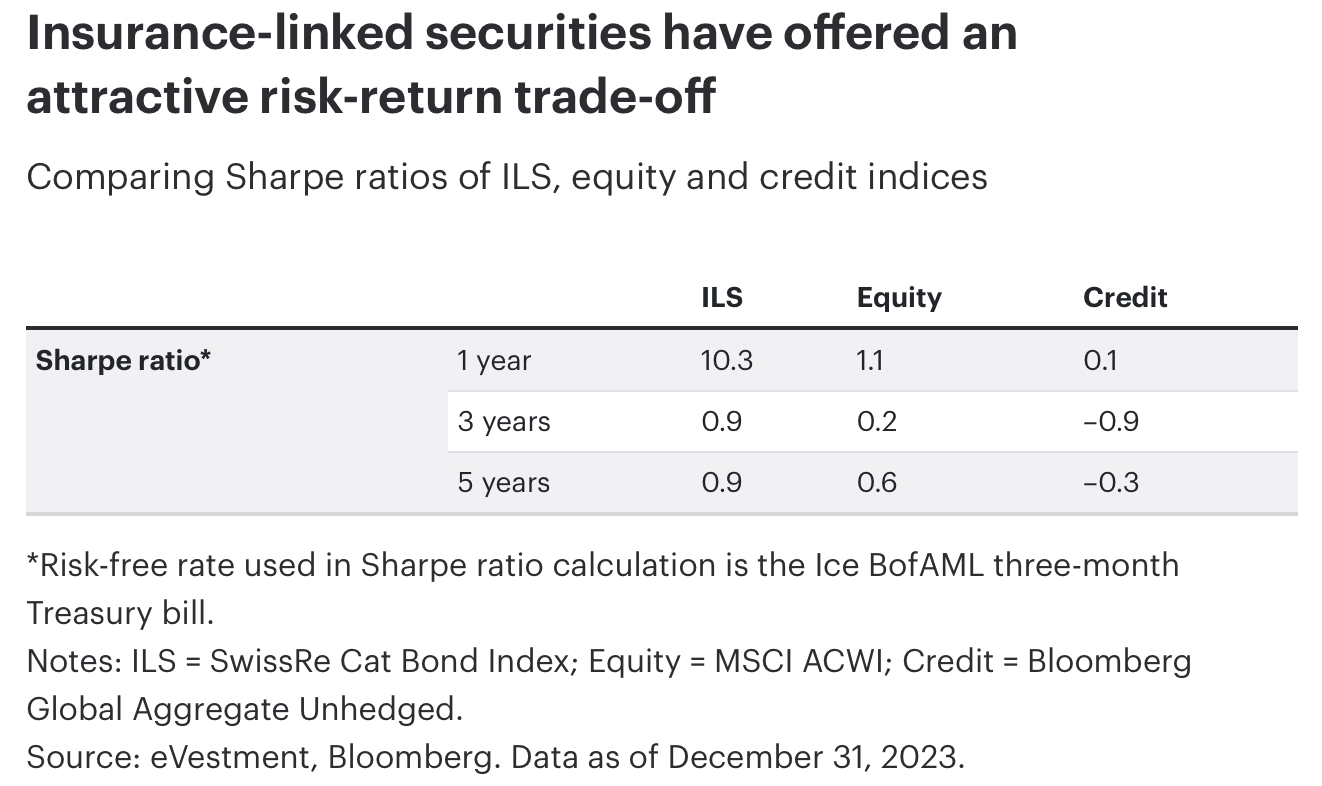

Sharing the beneath knowledge, the WTW Liquid Diversifiers workforce spotlight how effectively ILS has carried out lately, comparably with different asset lessons.

Cat bonds, “have outperformed equities and credit score on a risk-adjusted foundation for the previous a number of years. For fairness traders specifically, cat bonds have provided good diversification properties, with a beta to equities of lower than 0.2 since 2018.”

Summing up on investor’s workforce choice, the WTW Liquid Diversifiers workforce says, “A profitable workforce wants optionality on the switch window. Portfolio development ought to intention to think about each eventuality, together with remaining extremely liquid to offer flexibility with out sacrificing variety—one thing we expect liquid diversifiers are effectively geared up to do.

“It’s essential to notice that, whereas the diversification advantages and uncorrelated nature of liquid diversifiers could make them a compelling funding alternative, they don’t seem to be resistant to dangers and traders can expertise losses. A sound and systematic method is due to this fact wanted to observe and handle leverage, left-tail threat and supervisor choice threat.”